Five takeaways from Indiana’s 2018-2019 schedule release

Following an announcement from the Big Ten, Indiana released its complete 2018-2019 schedule on Tuesday afternoon. The Hoosiers will play 31 regular season games after playing just 30 last season.

Here’s a look at five takeaways from the release of this year’s schedule:

· The debut of the 20-game Big Ten schedule: The expansion of the Big Ten regular season schedule has arrived. For the first time in league history, Big Ten teams will play seven double plays and six single plays (three at home, three on the road) for a total of 20 regular season league games.

Along with the 20-game schedule, the 2018-2019 season will also mark the first time that certain rivalries will be protected, including Indiana-Purdue. The Hoosiers and the Boilermakers will always meet twice each season under the new format.

In addition to the protected rivalries, the league is also putting an added emphasis on regional matchups. According to the league’s press release issued last fall at Big Ten media day in New York, “over the course of a six-year cycle (12 playing opportunities), in-state rivals will play each other 12 times, regional opponents will play 10 times, and all other teams will play nine times.”

The new format should be a win-win for Big Ten programs, the TV networks and fans. The programs get more opportunities to resume bolstering wins, the TV networks get better inventory and the fans should (hopefully) get fewer guarantee games in November and December that don’t move the needle.

· Marquee opponents highlight non-conference slate: The addition of two conference games didn’t lessen the quality of opponents on Indiana’s non-conference schedule.

The Hoosiers should be well tested in the season’s first two months by the following games: Marquette in Bloomington, Arkansas in Fayetteville, UC Davis in Bloomington, Duke in Durham, Louisville in Bloomington and Butler in Indianapolis. All six of those opponents finished last season in the top 130 of the KenPom ratings.

In Bart Torvik’s preseason ratings, all six of those programs are rated in the top 87. The Hoosiers will play two true road games in hostile environments in the season’s first month, which should be solid preparation for ten conference road games.

· Last year’s one-day turnaround mess wasn’t repeated: Indiana was one of several Big Ten programs last season that was adversely affected by one-day turnarounds in conference play.

The Hoosiers had four such instances last season, but the misstep wasn’t repeated this year by the conference. Indiana will only have one such turnaround this season and it doesn’t come in conference play.

Still, there are some components of the schedule that could make Big Ten traditionalists roll their eyes. The Hoosiers will play three conference games on Friday night and will only play two conference home games on Saturday (Northwestern on 12/1 and Michigan State on 3/2).

· How good will Indiana’s “guarantee game” opponents be? One thing that constantly annoyed Indiana fans in the Tom Crean era was the abundance of sub-300 KenPom opponents on the non-conference schedule.

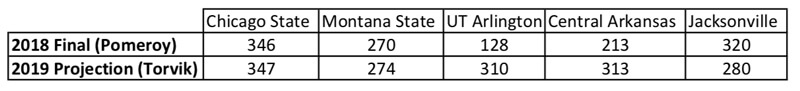

Pomeroy hasn’t released his preseason ratings yet, but there are some fairly large discrepancies for IU’s other five non-conference in the final KenPom numbers from last season to what Torvik projects for this season:

For the sake of Indiana’s strength of schedule, IU fans have to hope that UT Arlington and Central Arkansas are closer to their 2018 form than what Torvik is projecting for 2019.

· A tough road in January: The toughest stretch of Indiana’s conference slate comes from January 6 through February 2 when the Hoosiers will play six of eight on the road.

The road opponents during that stretch? Michigan, Maryland, Purdue, Northwestern, Rutgers and Michigan State. The two home games in the span are Nebraska and Michigan.

Indiana’s schedule is more favorable in the final weeks as the Hoosiers will play four of their final six regular season games at Simon Skjodt Assembly Hall.

Filed to: 2018-2019 schedule